[ad_1]

Markets reversed earlier gains and are now falling mid-morning Tuesday as investors hold their breath and await the March CPI report, which will indicate whether inflation will continue to slow.

All three major indices changed their direction, affecting the corresponding ETFs. spy, SPDR S&P 500 ETF Lost 0.5%, while QQQ, the Invesco QQQ TrustIt fell 0.4%. The QQQ often mirrors the performance of the high-tech NASDAQ due to its huge exposure to technology.

The long-awaited measure of inflation is scheduled to be released at 8:30 a.m. Wednesday, and is expected to rise 0.3% from the previous month, according to a poll of economists by Dow Jones.

Bond ETFs, which are highly sensitive to interest rates, rose Tuesday morning. TLT, iShares 20+ Year Treasure Bond ETF, jumped nearly 1% early in the trading session as bond yields fell. Bond ETFs have been under pressure all year as investors have been concerned about interest rate cuts in the current “higher for longer” environment.

It could be a CPI report Impact bond ETFs Also on Wednesday; A hotter-than-expected report would make investors believe that interest rate cuts will not be on the table for a long time (if ever), sending yields lower. If the CPI report comes in lower than expected or in line with expectations, yields could decline further. There is an inverse relationship between yields and prices, so when yields fall, prices rise.

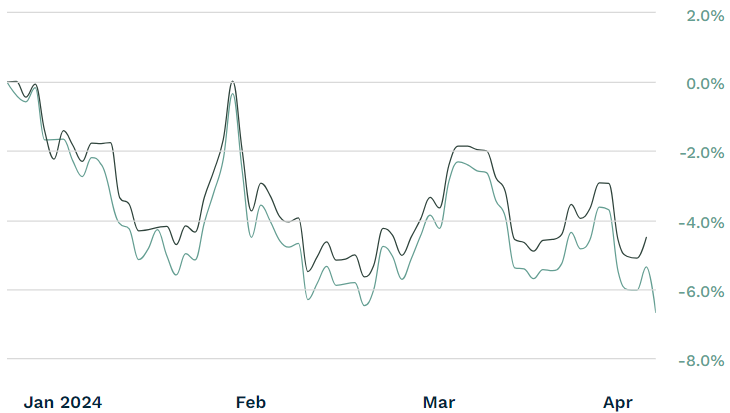

TLT Total Returns YTD

Currently, markets expect a 56% chance that the Fed will cut interest rates at its June policy meeting, according to CME's Fed Watch tool.

Gold prices hit new highs on Tuesday as investors looked for a safe haven amid concerns about interest rates. like High commodity prices This year, those holding commodity ETFs in their portfolios were able to take advantage of big gains. GLD, the SPDR Gold Trust, is up more than half a percentage point, while the index ETF is up more than 12.5% this year so far.

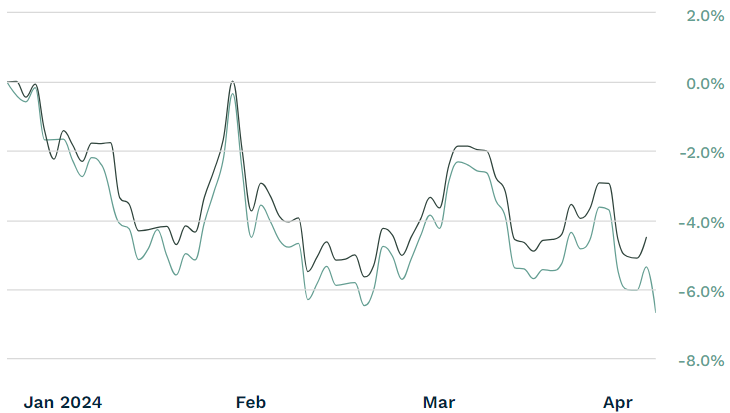

GLD performance for one year

Gold prices were affected by expectations of lower interest rates. Gold prices tend to move in the opposite direction to interest rates. When interest rates fall, gold prices rise as investors look for a better return than fixed income can offer, whose returns decline when interest rates fall.

However, questions remain If gold continues to rise at the long term.

[ad_2]

Source