[ad_1]

Despite a tough start to August, investor sentiment has remained resilient, with Standard & Poor's 500 The stock is up about 9% since its August 5 low.

This upward momentum was driven by a series of positive economic data, including better-than-expected initial jobless claims and strong retail sales figures.

Wall Street also reacted positively to comments from Federal Reserve Chairman Jerome Powell on Friday, indicating that the bank is ready to cut interest rates as the labor market weakens and inflation approaches the central bank's 2% annual target.

In this bullish mood, the key question is: How do you identify the next hot stock in this environment? One effective strategy is to focus on stocks with high upside potential that are endorsed by analysts from top-tier investment banks like Morgan Stanley. These experts bring valuable experience and in-depth knowledge to the table.

In fact, analysts at Morgan Stanley have highlighted two stocks that they believe are poised for big gains next year — with the potential to rise by 220% in either case. And if that’s not tempting enough, according to TipRanks DatabaseBoth stocks are also rated as Buy by analysts. Let’s see what drives the consensus praise.

Compass paths (CMPS)

The first Morgan Stanley pick we’ll look at is COMPASS Pathways, a biopharmaceutical company developing innovative treatments for hard-to-treat mental health disorders by harnessing the psychedelic effects of psilocybin. As the active compound in “magic mushrooms,” psilocybin has gained attention in psychiatric circles for its potential to effectively treat a wide range of mental health conditions.

COMPASS has developed a synthetic formulation of psilocybin, known as COMP360, which is designed to be used in conjunction with psychotherapy and support. The treatment process involves an initial series of sessions where the patient and therapist build a friendly relationship, followed by controlled drug administration sessions where the patient receives the psilocybin. During these sessions, the patient is closely monitored, and post-session discussions with the therapist help to process the experience.

COMPASS’s most advanced clinical program currently focuses on the use of psilocybin to treat patients with treatment-resistant depression (TRD), a severe mental health condition that significantly reduces quality of life. The company is investigating COMP360 in two Phase 3 clinical trials (COMP005 and COMP006); COMP005 is evaluating the effects of a single dose of monotherapy in 255 participants, with preliminary data expected by Q4 2024 or early 2025. Meanwhile, COMP006 is focused on repeated fixed-dose monotherapy in a larger cohort of 568 participants, with preliminary results expected by mid-2025.

In addition to this late-stage TRD study, the company’s COMP360 was the subject of an open-label Phase 2 study in the treatment of PTSD. The study enrolled 22 patients, focused on safety and tolerability, and reported positive results in the second quarter of this year. Based on these results, the company is now evaluating the best approach to developing a PTSD treatment.

Morgan Stanley analyst Vikram Purohit, who covers the stock, sees CMPS as a strong risk-reward opportunity. He highlights the company’s leading clinical program, saying: “Progress continues with the PhIII program for COMP360 in TRD, with the next key milestone being initial data from the PhIII COMP005 trial in Q4 2024… PhII data for COMP360 in TRD is competitive, feedback from key opinion leaders on the data and uptake potential for COMP360 is positive, and the commercial opportunity in TRD is well defined.”

“Based on the data generated and the stage of development for COMP360, CMPS appears to be significantly undervalued, and we believe the risk/reward is positively skewed on the data catalysts in 2024/2025 which we believe could lead to significant upside to the stock,” the analyst added.

To that end, Purohit rates CMPS stock as “Overweight” (i.e. Buy), and his $23 price target implies a strong one-year upside potential of about 220%. (To watch Purohit’s track record, see Click here)

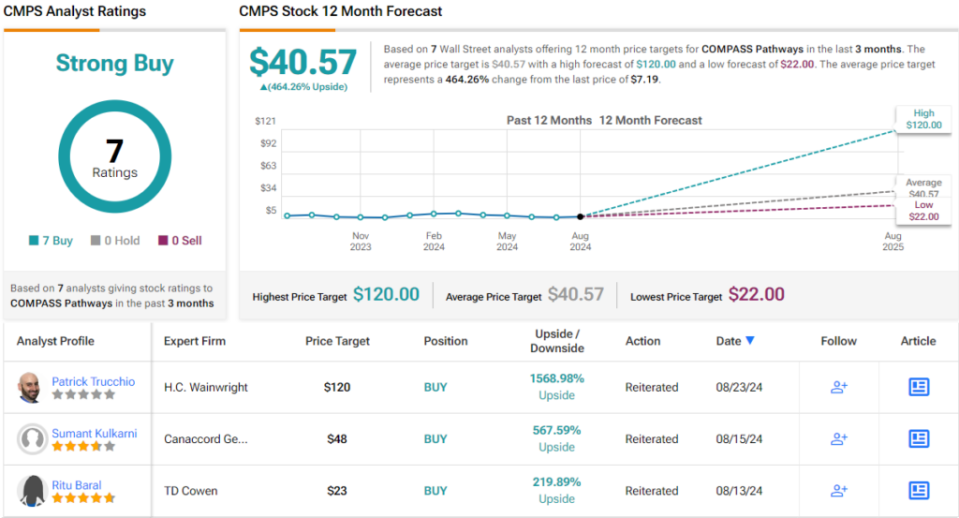

Purohit’s optimism is shared by the broader analyst community. Based on buy recommendations alone — 7 in total — analysts collectively rate CMPS a Strong Buy. With the stock currently trading at $7.19, the average price target of $40.57 implies an impressive 464% upside potential over the next year. (See CMPS Stock Forecast)

Rocket Pharmaceuticals Company (I kicked)

Next on Morgan Stanley’s list is Rocket Pharmaceuticals, a biotech company at the forefront of gene therapy. Rocket uses adeno-associated viral vectors (AAV) and lentiviral vectors (LVV) to pioneer treatments for complex and rare hematological and cardiovascular conditions, areas with significant unmet medical needs and limited treatment options.

Rocket’s most advanced programs focus on hematology. The company is developing LV RP-L102, a candidate designed to treat Fanconi anemia, and Kresladi, a potential treatment for LAD-1 disease.

On the Fanconi track, Rocket recently released positive data from its Phase 1/2 study and confirmed that regulatory filings remain on schedule.

In contrast, the company faced a setback in June when the FDA issued a full response letter to Kresladi’s biologics license application, requesting additional information from CMC to complete its review. Rocket management confirmed that the review process is ongoing and that it is actively collaborating with senior leaders and reviewers in the FDA’s Center for Biologics Evaluation and Research to resolve the issue.

On the cardiovascular front, Roket’s research programs are making good progress. Leading candidates include PR-A501 and RP-A601. PR-A501, a potential treatment for Danon disease, is currently in a pivotal Phase 2 study, while RP-A601, which targets PKP2-related arrhythmia cardiomyopathy, is currently being enrolled in a Phase 1 study.

Rocket's large and diverse pipeline caught the attention of Morgan Stanley analyst Michael Ohls, who was particularly impressed by the developments in cardiovascular disease.

“Our Overweight rating is based on Rocket’s position as a leading gene therapy company combined with a strong pipeline and experienced management team. We view RP-A501 (AAV) in Danon disease as a key driver with tremendous potential and see broader potential from the cardiovascular pipeline (PKP2 and BAG3). While we expect to focus on the cardiovascular pipeline, we believe the more advanced hematology franchise provides near-term opportunity,” said Oles.

Oles completes his Overweight (i.e. Buy) rating on RCKT with a $45 price target, implying a 142% gain for the stock over the next 12 months. (To watch Oles’ track record, see Click here)

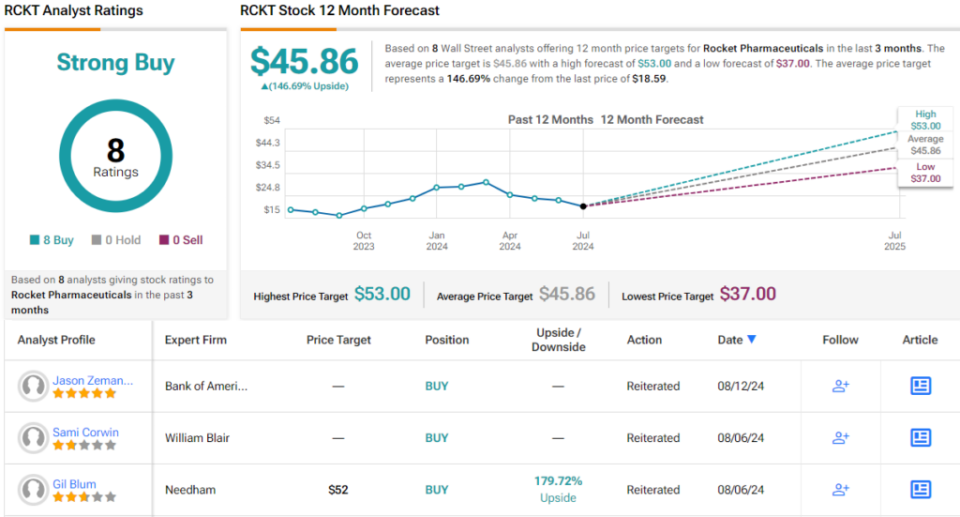

No one disputes this view on Wall Street. The stock's Strong Buy rating is based on just 8 Buy recommendations, in total. Forecasts predict annual gains of about 147%, given the average price target of $45.86. (See RCKT Stock Forecast)

To find good stock trading ideas with attractive valuations, visit TipRanks. Best Stocks to Buya tool that aggregates all of TipRanks' stock insights.

Disclaimer: The opinions expressed in this article are solely those of the participating analysts. The content is intended for informational purposes only. It is very important that you conduct your own analysis before making any investment.

[ad_2]

Source